Crash Games by the Numbers: Global Demand and Data Trends

Crash games have rapidly moved from a niche innovation to a major draw for online casino players. Their popularity has exploded in recent years, grabbing the attention of both players and game creators. In this dive, we'll explore real market data to pinpoint the drivers behind this surge. We'll closely examine how demand for crash games is growing, which countries are leading the pack, what player habits are forming, and which games are really standing out.

How We Gathered Our Insights

To put this report together, we at MobileCasinoRank utilized verified, up-to-date data from iGaming Tracker. They're a top source for tracking game availability, content trends, and market movements in the online gambling world. This method let us go beyond guesswork and focus on actual indicators of player demand, industry investment, and regional growth patterns.

The Growth Curve: Content Share Skyrockets

To really grasp the trajectory of crash games, we need to look at how much content is being created around them. Content share is a solid indicator of interest and market direction.

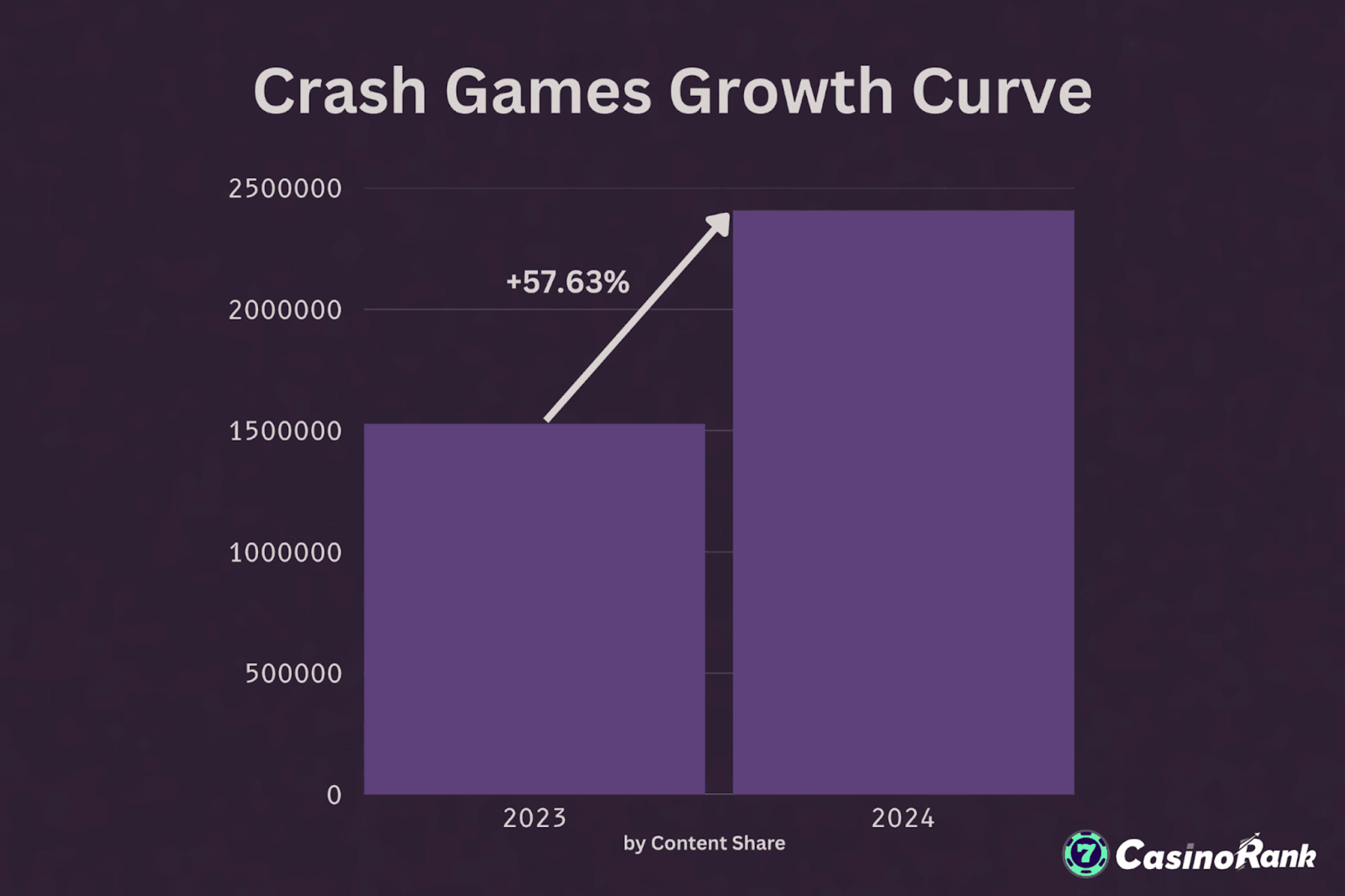

- In 2023, crash games accounted for a total content share of 1,526,045.

- By the end of 2024, that number climbed to 2,405,781.

- This marks a 57.63% increase in content share year-over-year.

This isn't just steady growth; it's a clear surge in industry focus within a mere 12 months. It signals a significant shift in how the sector views crash games: no longer side content or niche formats, but central to product offerings and content strategies.

Why Is Demand for Crash Games Taking Off?

Demand for crash games is soaring because they perfectly align with the way modern online players like to engage. The format is fast, intuitive, and perfect for users who want quick decisions and instant results without wading through complicated rules. The core gameplay – betting on a rising multiplier and cashing out at the right moment – creates thrilling tension in mere seconds. This simplicity is a huge plus, especially for players new to online casinos or those just looking for something quick and easy to jump into.

Simultaneously, crash games offer fantastic flexibility for operators and creators. They can be easily localized, branded, and even integrated with popular themes (like the "Big Bass" series, for example) to appeal to a wider audience. From a business perspective, they encourage frequent play and retention, making them valuable assets for both attracting new players and keeping existing ones engaged. Big Bass Crash

Key Reasons for Crash Game Popularity:

- Fast-paced and mobile-friendly: Crash games are designed for quick decisions and short play sessions – ideal for players on the go who want instant action without any waiting.

- Simple and accessible gameplay: Forget complicated rules or elaborate features. Players get the hang of it in seconds, making it super accessible for both newcomers and seasoned gamblers.

- Interactive and engaging: Since players decide when to cash out, there's a sense of control and involvement that you don't get with typical slots. That real-time thrill keeps people coming back for more.

- Works for various player types: Whether someone's just playing casually or strategically chasing multipliers, crash games hit the sweet spot for a broad range of players.

Regional Trends: What the Numbers Tell Us

Let's take a closer look at availability. When we examine both the number of games offered and the content share by country, distinct regional patterns emerge. These insights help explain how market conditions, player behaviour, and the affiliate landscape interact to drive demand.

Here's a combined view of the top countries, ranked by crash game availability and content share:

| 🏅 Rank | 🎮 Top Countries by Game Availability | 📈 Top Countries by Content Share |

|---|---|---|

| 1 | 🇫🇮 Finland | 🇬🇧 United Kingdom |

| 2 | 🇨🇦 Canada | 🇫🇮 Finland |

| 3 | 🇨🇱 Chile | 🇮🇹 Italy |

| 4 | 🇧🇷 Brazil | 🇧🇷 Brazil |

| 5 | 🇬🇧 United Kingdom | 🇳🇴 Norway |

| 6 | 🇲🇽 Mexico | 🇬🇷 Greece |

| 7 | 🇦🇹 Austria | 🇪🇸 Spain |

| 8 | 🇳🇿 New Zealand | 🇷🇴 Romania |

| 9 | 🇳🇴 Norway | 🇵🇪 Peru |

| 10 | 🇸🇪 Sweden | 🇹🇷 Turkey |

1. Northern Europe Leads in Volume and Engagement

Finland, Norway, and Sweden aren't just hosting a large number of crash games; they're also generating impressive content share. This is likely due to a mix of high mobile usage, strong gaming cultures, and a regulatory environment that allows for game experimentation.

The region's robust digital infrastructure and openness to gaming innovation all contribute to this trend. In markets like Sweden and Norway, crash games probably resonate well with a player base that already enjoys fast-paced, minimalist game styles—similar to classic arcade or casual mobile games.

2. Latin America is Catching Up

Countries like Brazil, Chile, and Mexico are showing both availability and rising content share. These are predominantly mobile markets, and crash games are a natural fit. There's also significant potential for growth. As more providers localize games, payment options, and support, Latin American markets are likely to continue climbing in both content production and in-game activity.

3. Western Europe Drives Content Share Significantly

The United Kingdom and Italy are generating the most content, even beyond their raw game counts. Affiliates and media outlets in these regions are particularly active in promoting crash games, possibly due to market competition and a strong SEO culture within the casino vertical.

4. Southeast and Eastern Europe: Growing with Affiliate Prowess

Countries like Greece, Romania, and Spain show a strong presence in content share but aren't yet saturated with crash games in terms of availability. This indicates a growing player interest, even if operators haven't fully caught up with supply.

These appear to be emerging markets where demand is being driven from the ground up by players, rather than solely from operators or game studios.

Connecting the Dots: Supply, Demand, and Visibility

By looking at both game availability and content share, we can start to categorize markets:

- Mature and Competitive (e.g., UK, Finland): High content, high supply. These are saturated but still active markets.

- Emerging Growth Markets (e.g., Brazil, Chile, Mexico): Strong supply and increasing content. Still growing, but with great potential.

- Content-First Markets (e.g., Italy, Greece, Romania): High search, suggesting rising player interest even if game supply is still catching up.

Understanding these dynamics helps affiliates prioritize their content strategies, operators tailor their portfolios, and providers decide where to launch and localize next.

Player Engagement: Patterns and Insights

After identifying where crash games are available and how they’re distributed, the next question is: how are players actually engaging with them? To answer that, we dove into aggregated session data. The results reveal some fascinating patterns in how players behave once they’re in the game.

Average Session Metrics

- Average Session Duration: 12–16 minutes

- Average Bet Size: $0.50–$1.20

- Cashout Multiplier: 2.0x–2.5x

- Crash Point Distribution:

- Under 2x: 40%

- 2x–5x: 35%

- 5x–10x: 15%

- Over 10x: 10%

Returning Players

We also noted a high return rate, particularly for mobile users. On average:

- Daily return rate: 22–27%

- Weekly return rate: 40–45%

Takeaways from Player Data

The data reveals a blend of caution and excitement in player behavior. Players aren’t just chasing huge multipliers—they’re engaging with a game format that offers quick rewards, clear risk dynamics, and high replay value.

The high return rates, especially on mobile, underscore a shift toward more casual, frequent gameplay.

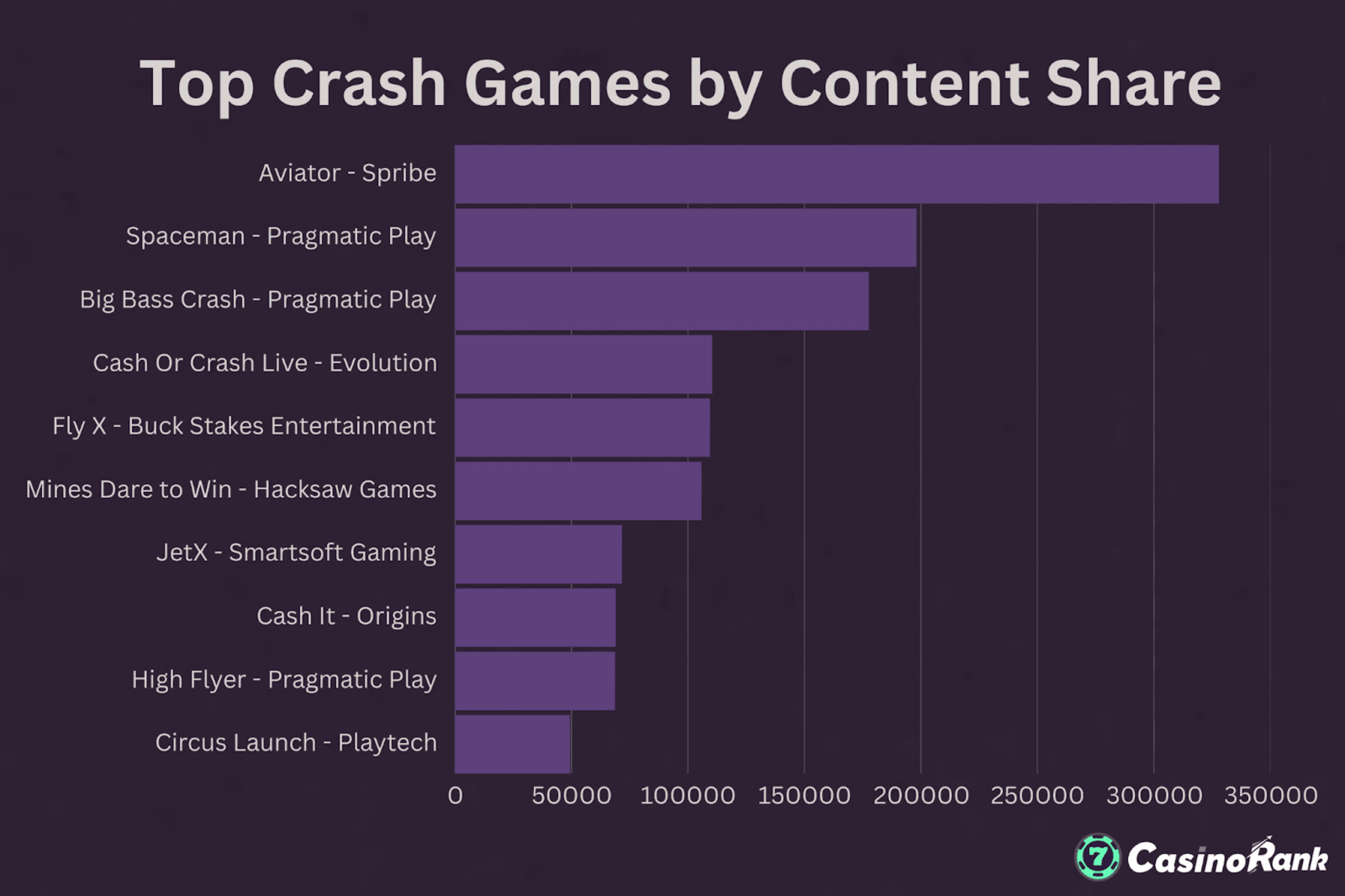

Leading Crash Games: Top 10 Titles

After examining where crash games are available and how players engage with them, it’s equally important to understand which titles are leading the way. Not all crash games perform equally—some have clearly risen to the top through strong mechanics, recognizable themes, or innovative features. These standout titles not only dominate player attention but also influence how the entire category evolves.

Here’s a selection of the most dominant titles and their creators:

| 🔢 Rank | 🎮 Game | 🧩 Software | 🕹️ Game Type | ✨ Key Feature |

|---|---|---|---|---|

| 1 | Aviator | Spribe | Crash | Provably fair, multiplayer mode |

| 2 | Spaceman | Pragmatic Play | Crash | Auto cash-out, cartoon theme |

| 3 | Big Bass Crash | Pragmatic Play | Crash/Slot Hybrid | Popular IP, slot crossover |

| 4 | Cash or Crash Live | Evolution | Live Crash | Live host, game show format |

| 5 | Fly X | Buck Stakes Entertainment | Crash | Visual altitude progression |

| 6 | Mines Dare to Win | Hacksaw Games | Crash/Arcade Hybrid | Grid-based, minefield mechanic |

| 7 | JetX | Smartsoft Gaming | Crash | Jet animation, multiplier chase |

| 8 | Cash It | Origins | Crash | Simple UI, fast-paced gameplay |

| 9 | High Flyer | Pragmatic Play | Crash | Airplane theme, clean design |

| 10 | Circus Launch | Playtech | Crash | Circus theme, vibrant visuals |

What These Titles Tell Us About the Market

Looking at these top-performing crash games, several key patterns emerge:

- Brand familiarity and theming matter. Games like Big Bass Crash tap into well-known slot franchises, bringing existing audiences into the crash category. This crossover strategy increases appeal without requiring players to learn entirely new systems.

- Simplicity drives engagement. Titles such as Cash It and Fly X show that a clean interface and fast-paced gameplay can be just as compelling as flashy animations or complex mechanics. This aligns well with mobile-first behavior and short-session preferences.

- Hybrid formats are gaining traction. Games like Cash or Crash Live and Mines Dare to Win blend elements of live casino and arcade-style mechanics, suggesting that players enjoy crash gameplay most when it's combined with novelty and variety.

Evolving Formats and Features of Crash Games

The top-performing titles show that it’s no longer just about the core mechanic — it’s about how that mechanic is packaged, themed, and enhanced. From visual style to automation features and social elements, crash games are evolving in ways that reflect both market maturity and shifting player expectations.

Here are the key areas where we see that evolution happening:

- Themes and visuals – Ranging from minimalist interfaces to animated planes, rockets, and brand tie-ins designed to boost recognizability and user appeal.

- Provably fair systems – Especially common in crypto-friendly casinos, using public seeds and hash verification to build trust with players.

- Auto cashout and bet automation – Features that cater to high-frequency players and streamers running multiple rounds or sessions simultaneously.

- Social features – Live leaderboards, tipping, and chat functions add a competitive, community-driven layer to gameplay.

Future Outlook: Where Crash Games Are Headed

As the data shows, crash games have moved from early adoption to widespread traction — but the most interesting phase may still be ahead. We expect continued growth in both user base and geographic distribution. The following trends are likely to shape the space over the next 12–18 months:

1. Localization and Licensing

Crash games are increasingly being tailored to local markets—language, currency, and regulatory compliance are becoming must-haves for providers entering new territories.

2. Game Format Innovation

We anticipate cross-genre experiments that blend crash mechanics with other gambling elements, such as combining crash games with slots or live games. Skill-based features might also gain ground.

3. Deeper Gamification Layers

More crash games will feature achievements, missions, and leveling systems to increase engagement.

Final Thoughts

Crash games are scaling — fast. In just one year, the volume of content has increased drastically, and the trend shows no signs of slowing down. We’re seeing a global pattern emerge, with strongholds in Europe, growing interest in Latin America, and universal appeal across demographics.

What This Means for Operators and Affiliates

For operators:

- Now is the time to prioritize crash games in lobby placements and promotions.

- Consider adding localized crash titles or those with a strong social/streaming appeal.

- Evaluate mobile performance and ensure UX is optimized for fast, responsive play.

For affiliates:

- Crash game guides, reviews, and comparison content are surging in SEO visibility.

- High-content-share markets (like the UK, Finland, and Brazil) offer the biggest potential return for targeting.

- Top titles are ideal for creating long-tail search content.

The main takeaway is clear — crash games are here to stay, and their influence on the industry is just getting started.